Professional Manufacturer of Biomagnetic Beads

In the current trade barrier war between China and the United States, magnetic bead raw materials, as the core raw materials in the fields of biomedicine and in vitro diagnosis, face multiple challenges such as supply chain security, technological blockade and high tariffs. In combination with global geopolitical games and technological development trends, the breakthrough path of China’s magnetic bead industry can be carried out from the following five dimensions:

First, accelerate domestic substitution and break through technical bottlenecks

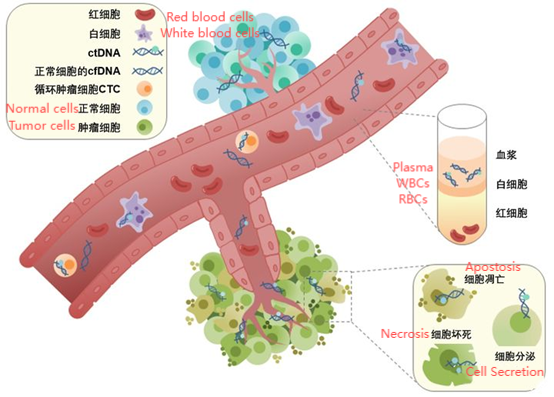

China has a rich foundation in the basic research of magnetic beads, but its industrialization capabilities are insufficient, especially in high-end GMP-grade magnetic beads (such as cell sorting magnetic beads), which have long relied on imports. The global market share is monopolized by American and Japanese companies, with 90% of the market being dominated. In recent years, domestic enterprises represented by Beijing Tongli Haiyuan have achieved technological breakthroughs. For example, the ActSep® CD3/CD28 sorting activation magnetic bead they developed has been registered with the FDA under Type DMF II, meeting international standards and has been validated in preclinical studies for the feasibility of replacing imports.

Technical difficulties: The industrial production of magnetic beads needs to solve the problems of nanoscale reaction control and batch stability. Domestic enterprises such as Shanghai LnjnBio have gradually narrowed the gap with imported products by optimizing the process.

Policy drive and industrial chain integration,China lists magnetic beads as one of the “chokepoint” technologies, promoting domestic alternatives through targeted support and R&D subsidies at the policy level. For example, the national “Seventh Five-Year” project supports the research and development of rare earth permanent magnet materials, indirectly driving the iteration of magnetic bead technology. At the same time, companies need to integrate upstream and downstream resources, such as combining rare earth separation and purification (China accounts for 70% of global production capacity) with magnetic bead manufacturing to reduce raw material costs.

Second,Take advantage of policy dividends to build industrial ecology

Policy support and approval processes are accelerating. China’s 14th Five-Year Plan for the bioeconomy lists key materials for cell therapy as a priority for research and development. The NMPA (National Medical Products Administration) is providing a 1-2 year expedited approval pathway for CAR-T products using domestically produced materials, encouraging companies to prioritize domestic magnetic beads. Local governments offer tax reductions and R&D subsidies in biopharmaceutical parks, further reducing innovation costs for enterprises.

Industrial chain collaborative innovation, domestic magnetic bead enterprises and CAR-T pharmaceutical companies (such as Yimiao Shenzhou, Chongqing Precision) establish a closed loop of strategic cooperation, and realize the whole chain verification from raw materials to final products to ensure the compatibility and stability of technology.

Through the industry-university-research joint platform (such as the Center for Excellence in Molecular Cell Science of the Chinese Academy of Sciences), basic research and industrial needs are promoted to solve the problem of micro-reaction control in the industrial production of magnetic beads.

Third, transit trade to avoid tariff barriers

Transshipment strategy in Southeast Asia In response to the high anti-dumping duties imposed by the United States on magnetic bead raw materials from China (such as tungsten beads 352.20%), enterprises can avoid risks through transshipment trade in Southeast Asia:

Operation process: The goods are first exported to the bonded areas of Malaysia, Thailand and other countries, and then transferred to the container and apply for the local certificate of origin (CO). Then they are exported to the United States in the name of a third country to legally bypass the tariff barriers.

Case verification: Chinese rubber magnet enterprises successfully avoided 185.28% anti-dumping duty through this scheme and resumed export orders to the United States.

Cost and compliance balance, re-export trade needs to ensure logistics timeliness and document authenticity, choose experienced logistics service providers (such as Shenzhen Jingwei Container) can reduce operational risks.

Fourth, global layout and market diversification

To expand into emerging markets, Chinese magnetic bead enterprises enter the US market through FDA DMF filing (such as 10 products of Beijing Tongli Haiyuan), and increase exports to Europe, Southeast Asia and other regions to diversify geopolitical risks.

Technology output and cooperation, through technology licensing or joint venture mode, cooperate with enterprises in emerging markets such as India and Brazil to reduce costs by taking advantage of their local production advantages and circumvent trade restrictions.

Fifth. Response to resource control and countermeasures

Rare earth countermeasures: China’s export control on dysprosium, germanium and rare earth minerals can counter the US high-tech industry (such as chip and magnet production) and indirectly protect the safety of its magnetic bead industry chain. For example, the US relies on China for 75% of its rare earth imports, and the weaponization of resources will force the US to make concessions in trade negotiations.

Countermeasures in service trade weaken the US advantage in service trade through the formulation of digital trade rules and intellectual property protection. For example, antitrust investigations against Google, Nvidia and other companies indirectly enhance China’s voice in the field of technical standards.

Conclusion: Multi-dimensional ice breaking, build a resilient supply chain

The future of magnetic bead raw materials requires the integration of three core logics: technological innovation, policy coordination, and trade strategy adjustment. In the short term, exports should be sustained through re-export trade. In the medium term, domestic substitution and technological upgrades should reduce dependence. In the long term, a global layout and resource countermeasures must form a strategic balance. Throughout this process, companies need to closely monitor policy developments (such as “digital trade” and “service trade” plans) and flexibly adjust their strategies to achieve a comprehensive breakthrough in “chokepoint” technologies in the Sino-US rivalry.

Supplier

Shanghai Lingjun Biotechnology Co., Ltd. was established in 2016 which is a professional manufacturer of biomagnetic materials and nucleic acid extraction reagents.

We have rich experience in nucleic acid extraction and purification, protein purification, cell separation, chemiluminescence, and other technical fields.

Our products are widely used in many fields, such as medical testing, genetic testing, university research, genetic breeding, and so on. We not only provide products but also can undertake OEM, ODM, and other needs. If you have a related need, please feel free to contact us at sales01@lingjunbio.com.